The NFT rocket ship lifts off

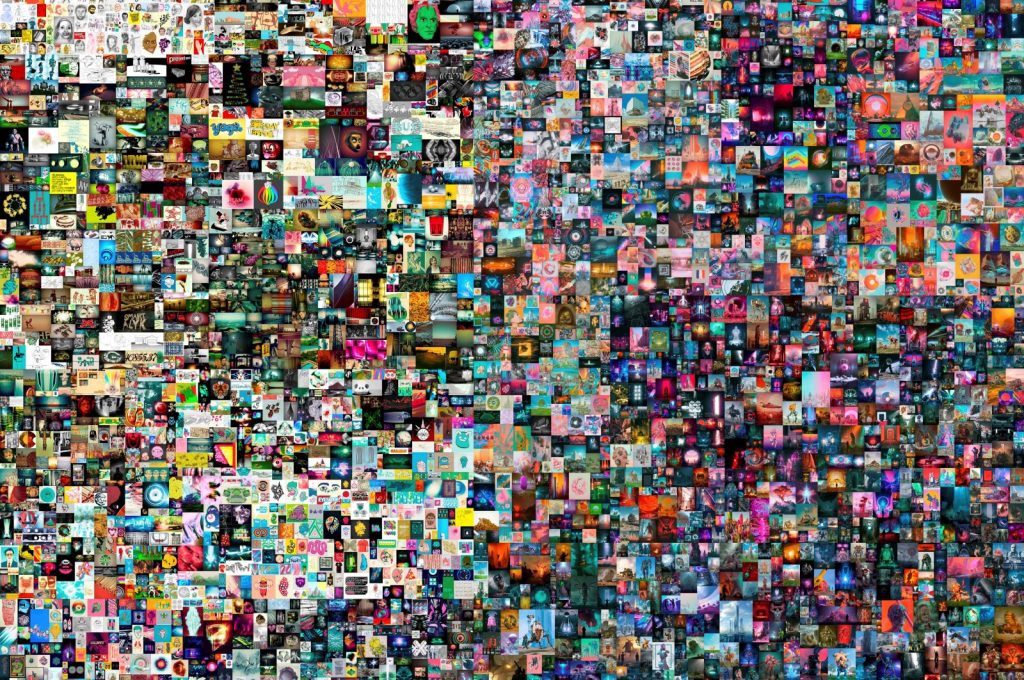

NFTs are on fire right now, at least in the proverbial sense. In March 2021, the artist Mike Winkelmann, known as Beeple, made history when he sold his non-fungible token (NFT) artwork, Everydays: The First 5000 Days for $69.3 million at Christie’s auction house. Likewise, Jack Dorsey sold his first tweet as an NFT for $2.9 million and Kings of Leon and other musical artists are gearing up to release albums as NFTs. NFTs are positioned to upend almost every creative industry from art to music to books to collectibles.

NFTs are also pretty easy to create (known as “minting” in crypto jargon). Given the tremendous interest in NFTs and the potential for significant profits to be made by minting, selling or trading NFTs people who work with NFTs must be familiar with applicable securities laws so they don’t run afoul of the law.

What is a non-fungible token, or NFT?

An NFT is a non-fungible token. NFTs are unique files that live on a blockchain and are able to verify ownership of a work of digital art. Buyers typically get limited rights to display the digital artwork they represent, but in many ways, they’re just buying bragging rights and an asset they may be able to resell later. The technology has absolutely exploded over the past few weeks — and Winkelmann, more than anyone else, has been at the forefront of its rapid rise.

Unlike most cryptocurrency, say Bitcoins, each NFT is a unique token that can’t be exchanged with another NFT. If you are selling a product, service or piece of art it doesn’t matter which dollar bill or which Bitcoin you receive from the buyer. In that sense Bitcoins — just like dollars — are fungible.

But an NFT token is a unique token that is publicly identified on the blockchain that it was created on. Each NFT also carries its own set of intellectual property rights. In a way, owning an NFT is like owning a limited edition print of an artist’s drawing – there are only so many prints that are created and each one is numbered and unique. In a similar way an NFT is a way to authenticate a piece of digital art or a digital collectible and identify its rightful owner and the rights he or she has.

What Makes an NFT Special?

Beauty lies in the eyes of the beholder, right? Well, maybe not. Anything unique that can be stored digitally and thought to hold value could become an NFT. This article could. My stick figure sketch of my son could. Essentially, they are like any other physical collector’s item, but instead of receiving an oil painting on canvas to hang on your wall, for example, you get a JPG file.

NFTs are part of the Ethereum blockchain so they are individual tokens with extra information stored in them. That extra information is the important part. It allows them to take the form of art, music, video (and so on), in the form of JPGS, MP3s, videos, GIFs and more. Because they hold value, they can be bought and sold just like other types of art – and, like with physical art, the value is largely set by the market and by demand.

However, that does not mean there’s only one digital version of an NFT art available on the marketplace. In much the same way as art prints of an original are made, used, bought and sold, copies of an NFT are still valid parts of the blockchain – but they will not hold the same value as the original.

NFTs and Securities Laws

Given the enormous profit potential associated with creating and trading NFTs it is only natural for NFTs to bump up against securities laws and regulations. Those who operate in this space must be familiar with how the securities laws will impact NFTs. Failure to comply with the securities laws has severe consequences including stiff fines by federal and state securities regulators, court injunctions and, in egregious cases, criminal charges. Thankfully, these risks can be reduced by consulting a securities lawyer who is familiar with NFTs and their associated regulatory framework. Whether a particular NFT is deemed to be a security or not will depend heavily on the purpose it was created for and how it is marketed to buyers. A “security” is defined in the Securities Act of 1933 and the Securities and Exchange Act of 1934 and includes many of the types of things you would typically associate with an investment – like shares of common or preferred stock. But the Securities Act also has a catchall term called an “investment contract” that can sweep up NFTs in the definition of a security. If an instrument or digital asset falls under the definition of a security a complex and costly regulatory regime will apply to the creation and sale of such securities – something that most people would rather avoid if possible to do so.

So what is an investment contract? That term was defined by the U.S. Supreme Court in the landmark case SEC v. W.J. Howey Co., 328 U.S. 293 (1946). That case created the Howey test to determine whether an instrument or product is an investment contract (and therefore a security) or not. Under the Howey Test, an instrument or product will be deemed an investment contract if:

- there is an investment of money;

- there is an expectation of profits from the investment;

- the investment of money is in a common enterprise; and

- any profit comes from the efforts of third parties.

While the Howey court focused on the “money,” later cases expanded this concept to cover any asset or thing of value and not just cash. The SEC has used the Howey test to find various offerings of digital assets and crypto currencies to be securities and, therefore, subject to sanctions when their creators and marketers did not comply with the securities laws by registering their sale and providing full, accurate and fair disclosures. The SEC has also publicly posited how the Howey test applies to digital assets here.

Why would an NFT be considered a “security” in the eyes of the law?

In the case of NFTs that constitute art or collectibles, on the surface, such NFTs should arguably not be deemed to be securities. (Needless to say, any given NFT would have to be analyzed on its specific facts.) These NFTs are essentially finished products whose value is determined at a sale that is made directly to a buyer. For such NFTs to maintain or appreciate in value, there is typically no expectation or need for third parties to extend managerial efforts that will enhance the value of the NFT. As noted by the SEC staff in its 2019 Framework, “Price appreciation resulting solely from external market forces (such as general inflationary trends or the economy) impacting the supply and demand for an underlying asset generally is not considered ‘profit’ under the Howey test.” (More on However later.) In other words, an NFT is not a security simply because it can increase in value.

Whether an NFT is a security will turn on, among other factors, the purpose for which it is being created and sold. If the NFT relates to an already existing asset, like a photograph or piece of digital art, and is marketed as a collectible with a public assurance of authenticity on the blockchain it is unlikely that such an NFT would be deemed a security. However, if the NFT is being created and sold as a way for members of the public to earn investment returns then that type of NFT will be more likely to be considered a security.

And it’s not just the creators of NFTs that have to be concerned with whether an NFT is a security. Those who operate NFT exchanges also have to carefully consider this issue. If an NFT exchange is making a market in an NFT that is deemed to be a security that NFT exchange platform could be deemed to be illegally operating an unregistered securities exchange and subject to sanctions by the SEC.

Conclusion

It’s still early for NFTs. But we expect them to continue to proliferate, gain popularity and widespread adoption. Their application is nearly endless. But as they continue to impact more people and more fields, interesting legal issues are certain to arise, including securities laws issues. Working with an experienced counsel well-versed in both technology and securities law will help assure your project’s success and make it significantly less likely that you run afoul of any applicable law.

Leave a Reply